Legal expertise in financial services and banking regulations

- Chapter 7 Corporations Act financial products and financial product advice

- Future of Financial Advice reforms, including conflicted remuneration, financial advice frameworks, licensee and adviser obligations

- Secured and unsecured consumer credit products and credit related insurance (home loans, mortgages and related security arrangements, credit cards, personal loans) under the National Consumer Credit Protection Act

- Privacy and data protection under the Privacy Act, Australian Privacy Principles and Credit Reporting Code of Conduct

- Scheme credit cards and debit cards

- Digital banking platforms including internet, mobile and wearables technology and delivery of paperless documentation under the ePayments Code

- Private label and white label banking products

- Other aspects of the retail banking and financial services regulatory framework including Code of Banking Practice, Spam Act, Australian Securities and Investments Commission Act

Services we offer

Services can range from ad hoc advice work to in-house placements, coverage for overflow work, routine legal work, policy reviews and regulatory compliance projects.

The type of work we do

We provide advice to financial product advice licensees and credit licensees as well as authorised representatives.

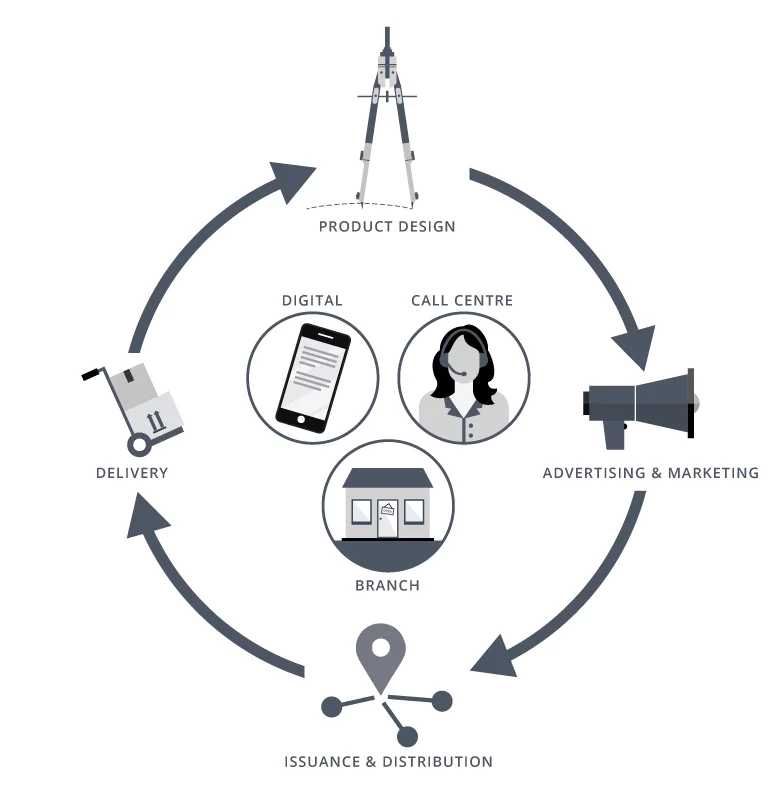

We provide advice on the product lifecycle through all distribution channels (digital, call centre, branch). We have experience working on the legal aspects of every stage of the lifecycle from product design to marketing and advertising, issuance and distribution, through to delivery.

We can solve problems for your business in the areas of:

- Regulatory change or review projects

- Policies, procedures and compliance manuals

- Compliance breaches and remediation

- Contract review and negotiations

- Standardisation of documentation or terms and conditions for specific products or transactions

- Legal or compliance training